Pix is the instant payments scheme developed, managed and operated by the Central Bank of Brazil....

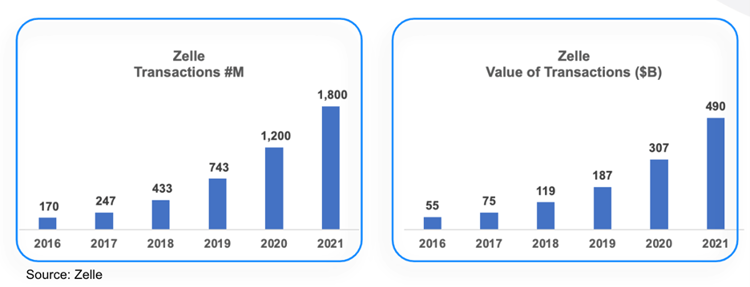

The adoption of instant payments has been slow in the U.S. relative to other markets, but the growth of Zelle’s P2P service is a strong statement that consumers value quicker delivery of funds into their bank account.

Zelle isn’t technically an instant payment scheme as it leverages ACH, debit or wire and settles transactions in batch at the end of the day. But, the Zelle experience does make money immediately available in a consumer’s bank account, and the recently announced “Zelle over RTP” is their new effort to settle transactions instantly using The Clearinghouse’s RTP network.

Zelle is now processing an estimated 150M transactions per month, a number that is approximately 10X that of RTP.

Nearly 1700 banks and credit unions now offer Zelle in their mobile banking apps. Zelle is owned and operated by Early Warning, a company run by the following seven U.S. banks - Bank of America, BB&T, Capital One, JP Morgan Chase, US Bank, Wells Fargo and PNC Bank.